Diminishing value depreciation example

Diminishing value method If the asset cost 80000 and has an. Second Year diminishing value claim calculation.

Tax Depreciation Schedule Methods Capital Claims

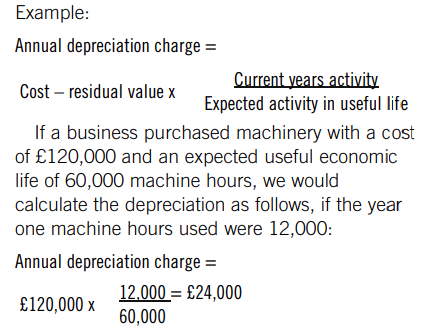

Buying an espresso machine for 10000 If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

. The rate of depreciation is applied to the diminishing value of the asset. Diminishing Balance Method Example 1. Depreciation is applied at a fixed proportion to the book value of the asset according to the.

Deprecation value period 2 10000 - 200000 02 160000 etc. The following formula is used for the diminishing value method. Purchased 1 March 2006.

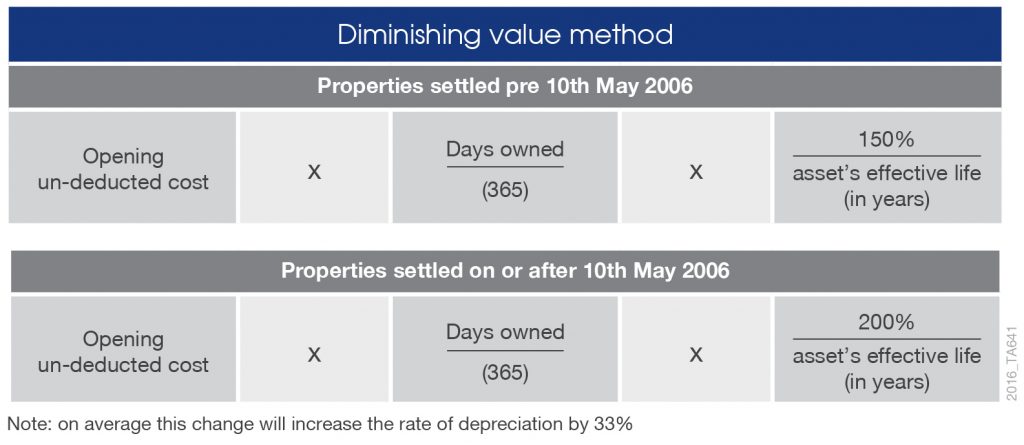

Useful Life 3 Years. Example of Diminishing Balance Method of Depreciation. Meanwhile the diminishing value depreciation method will permit for an increased depreciation deduction in the initial few years of property ownership.

8100 Mathematical Ex See more. View Diminishing_Value_Method_and_Example_PPT from AF 314 at University of the Fraser Valley. Lets say you re-carpet your unit which is an investment property at a cost of 2000.

If the asset cost 80000 and has. With this method we need to estimate the amount of depreciation we expect it to have. A company has brought a car that values INR 500000 and the useful life of the car as expected by the buyers is ten years.

The diminishing balance depreciation method also results in a lower depreciation expense in the. Your company just bought a car valued at USD105000 and the expected useful life of the car would be ten years and the residual value of the car is expected USD5000. See Note Example 2.

On 01042017 Machinery purchased for Rs 1100000- and paid for transportation charge 150000- to. The rate of depreciation is 30 percent. The value of our car is.

Prime Cost Depreciation Method If an asset costs 50000 and has an effective life of 10 years you can claim 10 of its cost in each of the ten years. The two methods can. For the second year the depreciation charge will be made on the diminished value ie Rs 90000 and it will be 90000 10 R s 9000 Now the value of the equipment becomes 90000 9000 Rs.

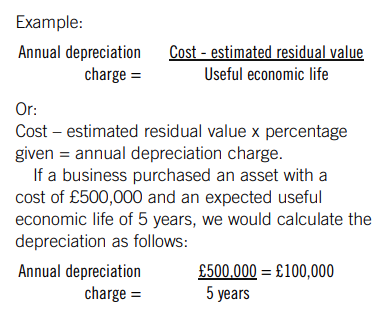

Fixed Assets and Depreciation Diminishing Value Method Diminishing Value Method. Tax Year ends 30. Calculate the annual depreciation rate ie 100 5 years 20.

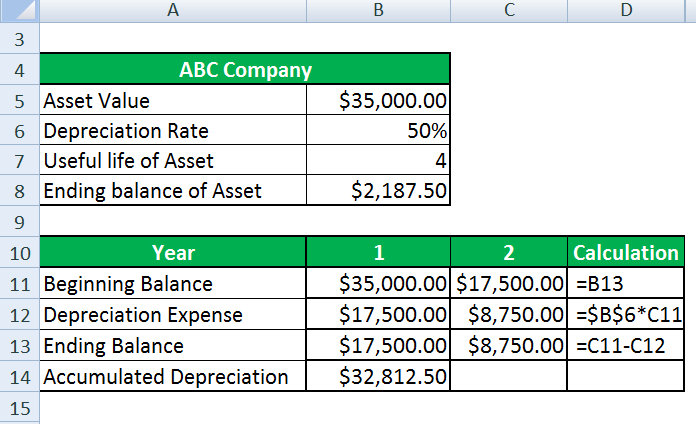

Rate Adjustments - Diminishing Value Depreciation Method Example. Depreciation Rate 50. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

As said earlier sometimes you dont reach the salvage value when you use this function. In this example the base value for the second year will be 80000 32000 48000. In this example if we subtract the.

As the book value reduces every. Multiply the beginning period book value by twice the regular annual rate 1200000 x 40 480000. 81000 Similarly for the third year the depreciation charge will be 81000 10 R s.

According to the Diminishing Balance Method depreciation is charged at a fixed percentage on the book value of the asset. And the residual value is. An example of the Diminishing Value is as follows.

For the purpose of this example lets say 20 per year. Base value days held 365 200 assets effective life Days held can be 366 for a leap year. Assets cost days held365 Depreciation rate.

48000 365 365 200 5. Carpet has a 10-year effective life and you could calculate the diminishing.

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Written Down Value Method Of Depreciation Calculation

Written Down Value Method Of Depreciation Calculation

Download Depreciation Calculator Excel Template Exceldatapro Excel Templates Fixed Asset Cash Flow Statement

Depreciation Formula Calculate Depreciation Expense

What Is Depreciation Pq Magazine

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Straight Line Vs Reducing Balance Depreciation Youtube

Depreciation Calculation

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

What Is Depreciation Pq Magazine

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Formula Examples With Excel Template

Written Down Value Method Importance Of Written Down Value Method

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Diminishing Value Vs The Prime Cost Method By Mortgage House