51+ what percent of gross income should go to mortgage

Multiply this number by 100 to get a percentage. Ad Take the First Step Towards Your Dream Home See If You Qualify.

What Percentage Of Income Should Go To Mortgage

BancorpSouth customers Cadence.

. Ad Compare Home Financing Options Get Quotes. Updated FHA Loan Requirements for 2023. Twenty-eight percent of this amount is 1301.

Web There are four common models prospective homebuyers use to calculate the percentage of income they should spend on a monthly mortgage payment. Say youre making 4648 every month. For example if you make 10000 every month multiply 10000 by 028 to get.

When determining what percentage of income should go to mortgage a mortgage broker will typically follow the 2836 RuleThe Rule states that a household should not spend more than 28 percent of its gross. But thats a very general guideline. A lender suggests to not have more than 28 of persons gross.

We recommend an even better goal is to keep total debt to a third or 33. In this case you would calculate. What percentage of income should mortgage be.

Use Our Tool To Find Out If You Qualify. John in the above example makes 82000 annually or 6833 per month. Try our mortgage calculator.

This means if 10 of your income goes toward other debts you may be limited to 26 of your income for housing payments instead of 28. Web Then divide that gross monthly income by the expenses total from Step 1. Web Find your monthly gross income by reviewing your recent paystubs.

Web Your monthly mortgage and homeowners insurance payment must be lower than 28 percent of your gross income to have the most loan programs available to you. This 28 is often referred to as a safe mortgage-to-income ratio or a good general guideline for mortgage payments. Web Most lenders look for a maximum DTI of 40 on applications for most sorts of mortgages.

Check Official Requirements See If You Qualify for a 0 Down VA Home Loan. The 28 Rule As the name suggests this rule states that no more than 28 percent of your gross income should go toward your monthly mortgage payment. Ad Get an idea of your estimated payments or loan possibilities.

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. 25 of Net Income.

You can determine whether you are below the 28 percent benchmark by. Ad See what your estimated monthly payment would be with the VA Loan. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income.

To find your maximum mortgage payment with the 28 rule multiply your monthly income by 28. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property taxes and insurance. Find A Lender That Offers Great Service.

Note that 40 should be a maximum. This method allows you to. BancorpSouth and Cadence Bank have come together.

Web What Percentage Of Your Income Should Be Your Mortgage. Housing ratios and debt-to-income ratios are ways of calculating the percentage of gross income for mortgage payments and who qualifies. Web As a general rule of thumb your monthly housing payment should not exceed 28 percent of your income before taxes.

28 of his income looks like. Then multiply that number by 028 to find the maximum you should be spending on your mortgage payment. Lenders want to make sure these expenses dont exceed 36 of your monthly gross income.

Web What Is The Percentage Of Income Rule. Some applicants get approved with DTIs or 45 or occasionally even 50. Heres what you need to know.

Compare More Than Just Rates. Another calculation you can use to find how much of your income you can spend on your mortgage payment is the 25 method. Web Back-end DTI includes all of your debt payments in addition to the proposed mortgage payment.

Lets say you have a monthly income of 6000. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Whats an ideal mortgage-to-income ratio.

Web The 28 rule. 6833 x 028 1913 This is the TOTAL mortgage payment. Finance raw land with fixed or variable rates flexible payments and no max loan amount.

Cadence Bank answers these questions and more for you here. Aim to keep your total debt payments at or below 40 of your pretax monthly income. Web This means that no more than 28 of your monthly income should go to your mortgage payment every month.

To determine how much you can afford using this rule multiply your monthly gross income by 28. It is important that prospective homebuyers take time to carefully establish how much house they can afford and what percentage of income should go towards their monthly mortgage payment. Web Cadence Bank What Percentage of Income Should Go to Mortgage.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. On a 400000 property a 20-percent down payment is 80000. Check Your Official Eligibility Today.

The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. The 28 rule specifies that your mortgage payment shouldnt be more than 28 of your monthly pre-tax income. But those approved with big DTIs are almost always strong borrowers in other respects.

The answer is the share of your income that goes toward paying off. Web To determine how much income should be put toward a monthly mortgage payment there are several rules and formulas you can use but the most popular is the 28 rule which states that no more than 28 of your gross monthly income should be spent on housing costs. A low ratio allows you to qualify with more lenders which gives you a better opportunity to get the best terms.

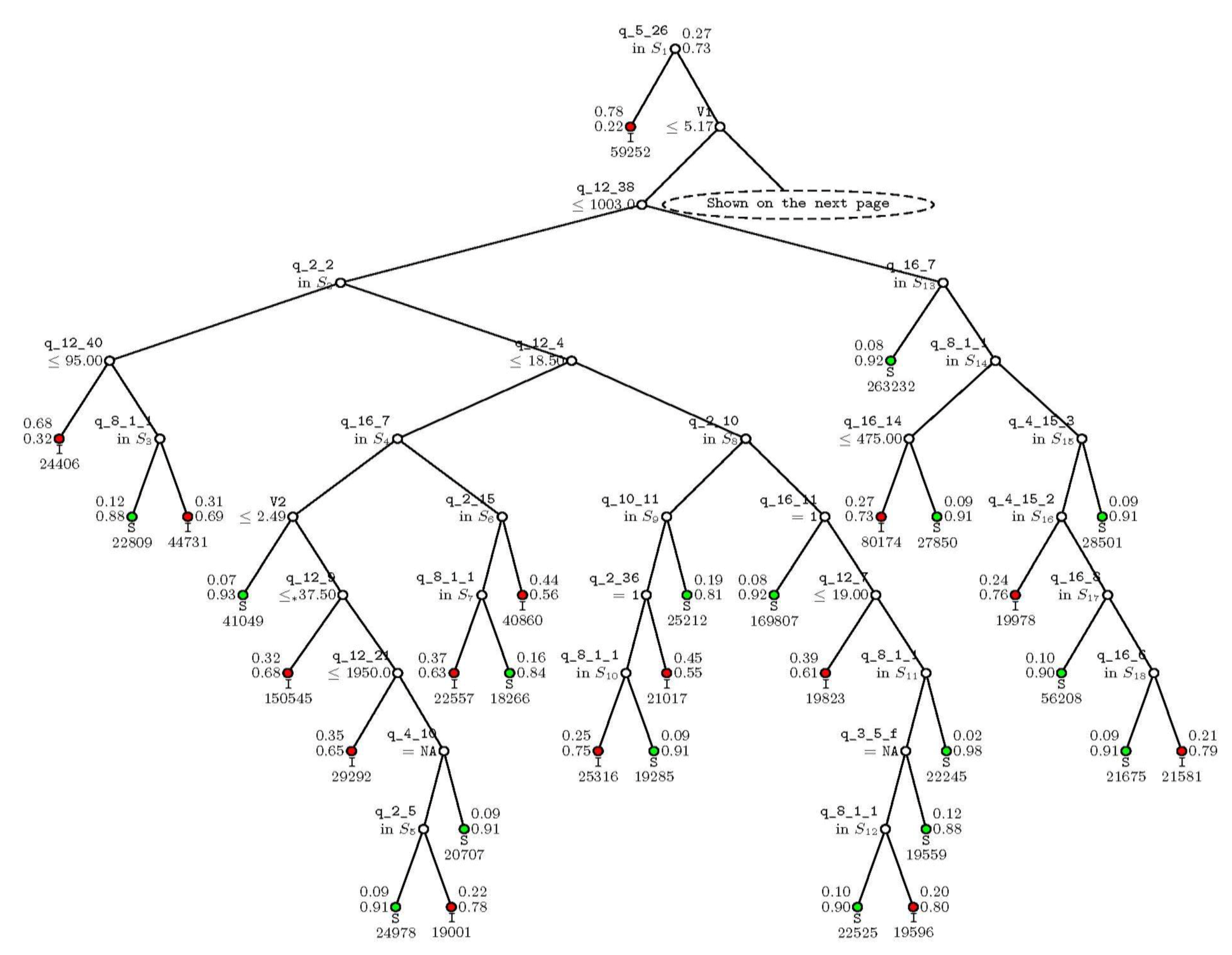

Sustainability Free Full Text Identifying Vulnerable Households Using Machine Learning

How Much Of My Income Should Go Towards A Mortgage Payment

Enhancing Job Opportunities Eastern Europe And The Former Soviet Union By Open Access Library Issuu

Income To Mortgage Ratio What Should Yours Be Moneyunder30

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

What Percentage Of Income Should Go To A Mortgage Bankrate

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Pdf A Consumer Survey Of Attitudes To Exceeding Minimum Standards For Refurbishments And Retrofits

House Price Markups And Mortgage Defaults Carrillo Journal Of Money Credit And Banking Wiley Online Library

Pdf Exploitation In Contemporary Capitalism An Empirical Analysis Of The Case Of Taiwan Arthur Sakamoto Academia Edu

How Much Of My Income Should Go Towards A Mortgage Payment

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much House Can I Afford Moneyunder30

What Percentage Of Annual Income Should Go To Rent

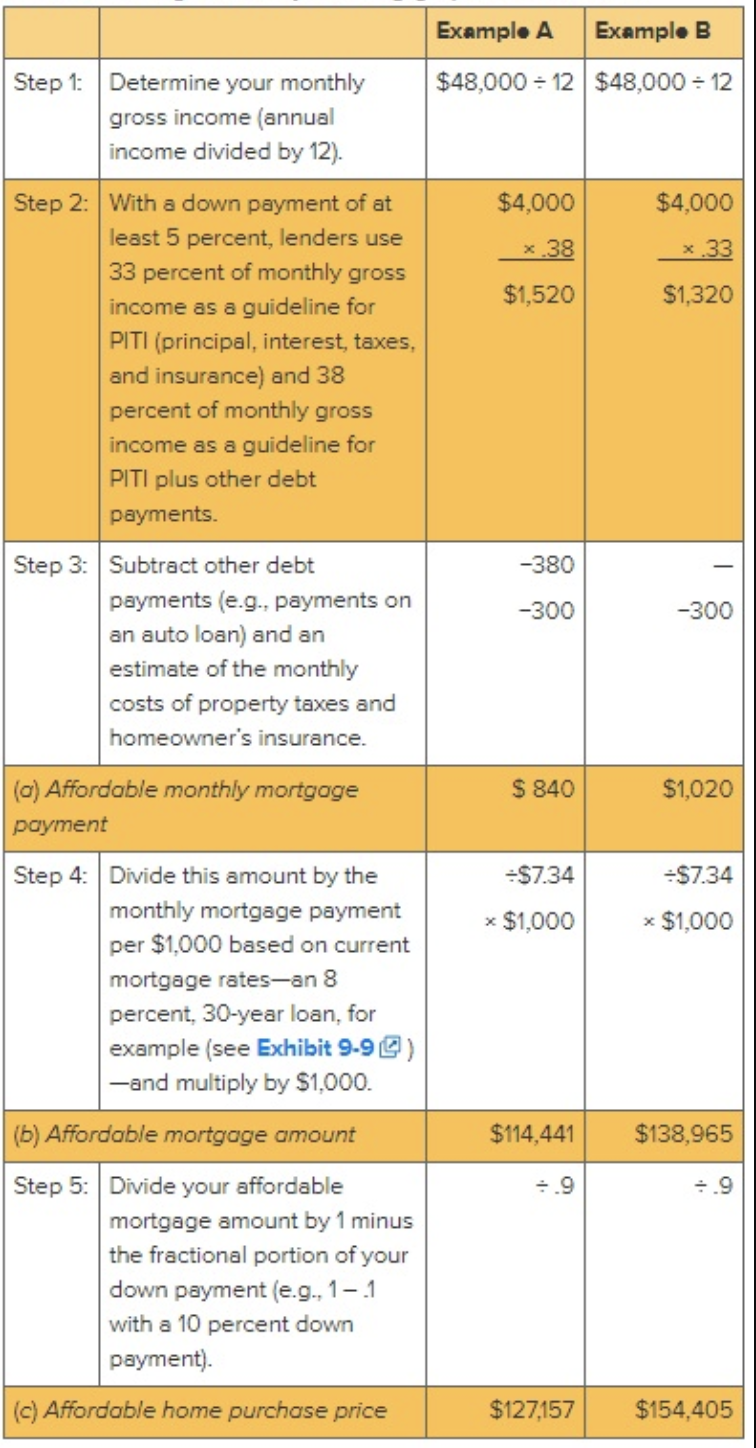

Solved Exampl A Exampl B 48 000 12 48 000 12 Step 1 Chegg Com

What Percentage Of Income Should Go To Mortgage Morty

What Percent Of Gross Income Should Go To Mortgage House Insurance Pocketsense